Antigovernment protests affecting the Middle East and North Africa have now escalated to previously unforeseeable levels of widespread socio-political unrest. These unprecedented events are a consequence of the rising demand of rights similar to those found in Western liberal democracies and have directly led to a state of negative economic backlash. Perhaps, western observers should be asking, is the West to fear yet another an oil crisis?

Contrary to the Egyptian leader’s decision to step down after weeks of protests and obvious feelings of disenchantment with the regime, Libya’s dictator Muammar Gaddafi – who has been in power for over 40 years – has resolved to remain in power by opting to start a civil war-like conflict. Despite accusations from home and abroad, Gaddafi denies any wrongdoing by claiming that those protesting are members of al Qaeda and that “all his people love him”.

From an investor’s point of view, having dictators rule a country is not necessarily economically unfavourable as one might see them as contributors to the stability of the nation in question. It is probable that this is the reason the West had few qualms surrounding the previous state of oil imports from Libya. In certain situations of the past, this has proved to be true. In any case, sometimes the existence of dictatorially-created stability helps attract more investors that are in return willing to turn a blind eye to possible domestic issues, especially in emerging markets such as Libya that offer high-risk but also potentially high-gain economic opportunities.

Libya typically produces around 1.4m barrels of oil a day, which is around 2% of petroleum for export on the world market. This might sound like a small figure but the unfolding of the current events is having a colossal impact on international oil markets. To begin with, many oil workers have fled the country causing a significant decrease in oil production and thus affecting oil export to Western countries. Amongst locations with a reported decrease in petroleum production is Brega, home to Libya’s second-largest oil facility. Although the facilities here have not yet been damaged, Mohammed Khamis, an employee at Sirte Oil Company, has said last Thursday that these were operating “at less than 10 per cent capacity”.

As Libyan petroleum extraction, refinery and exports are being jeopardised, tremors are being sent throughout the world’s economy. There is undeniable fear amongst investors and traders: the cost of a barrel of Brent crude oil has risen from a low of $80 (approx. £49) last year to around $115 (approx. £71) – an increase of approximately 44% – according to the Economist. The situation is so severe, that US Federal Reserve chairman Ben Bernanke said “if rising commodity prices threaten to trigger inflation or choke off the economic recovery,” then they are “prepared to respond as necessary”.

The world has learned from the past when political changes caused large disruptions in oil supplies and has dealt with these changes via OPEC (Organisation of the Petroleum Exporting Countries) that aimed to strive off interruptions to world oil supplies. The problem however, even with OPEC in place, is the cost of transportation is still an issue. It is considerably cheaper to have oil transported from Libya due to its strategic geographic position in relation to Europe. This is why with the fall in production from Libya, oil prices are increasing proportionally to transportation costs needed to cover the distance of oil producers from further locations such as Saudi Arabia.

OPEC is an intergovernmental organisation created in order to regulate oil production by primarily controlling the ratio of oil that each member country is allocated to produce. In addition, the classification of oil as a commodity is another technique employed by the financial industry to help regulate its price. By employing this technique, the industry recognises that oil is valued equally regardless of the country of production. This makes trading oil much simpler since the only influential factor is price per barrel.

The Economic Effect of the Libyan Protests

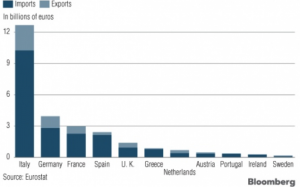

The effects of the Libyan protests are indisputable and very-far reaching. One must note that some countries, like Switzerland, have a strong reliance on Libyan oil, with over 50% of petroleum coming directly from Libya. Italy encounters another significant problem, as it is Libya’s biggest trading partner: with the EU Debt crisis that has deeply affected countries like Greece and Ireland, many analysts believe that Italy may be amongst the countries soon to follow suit. Given Italy’s already delicate situation, if the EU decides to sanction Libya, then Italy itself may become ‘the straw that broke the camels back’, in respect to the EU Debt crisis.

BP is also finding itself in greater financial difficulties after having only just recovered from the economic setback of the Gulf of Mexico spills, which caused them a loss of $4.9bn, according to the Financial Times. The issue with oil production in Libya, as a result, may only serve as a detriment to its recent economic recovery.

How Does This Affect You

Historically, a small increase in oil prices was sufficient to prompt a recession, with this effect being greatest in the fifties. Even though in today’s economy we are not as dependent on oil, any change on its costs acts as a tax on commuters and cuts spending power of individuals.